Let’s be real: Nobody wants to deal with impound insurance. It’s usually the result of an “oops” moment — like forgetting to renew your policy or letting your mate drive your car “just around the corner.” But here we are. Let’s break down what actually happened in 2024, what the stats are saying, and what might be coming in 2025. Buckle up — it’s not all doom and gloom (promise).

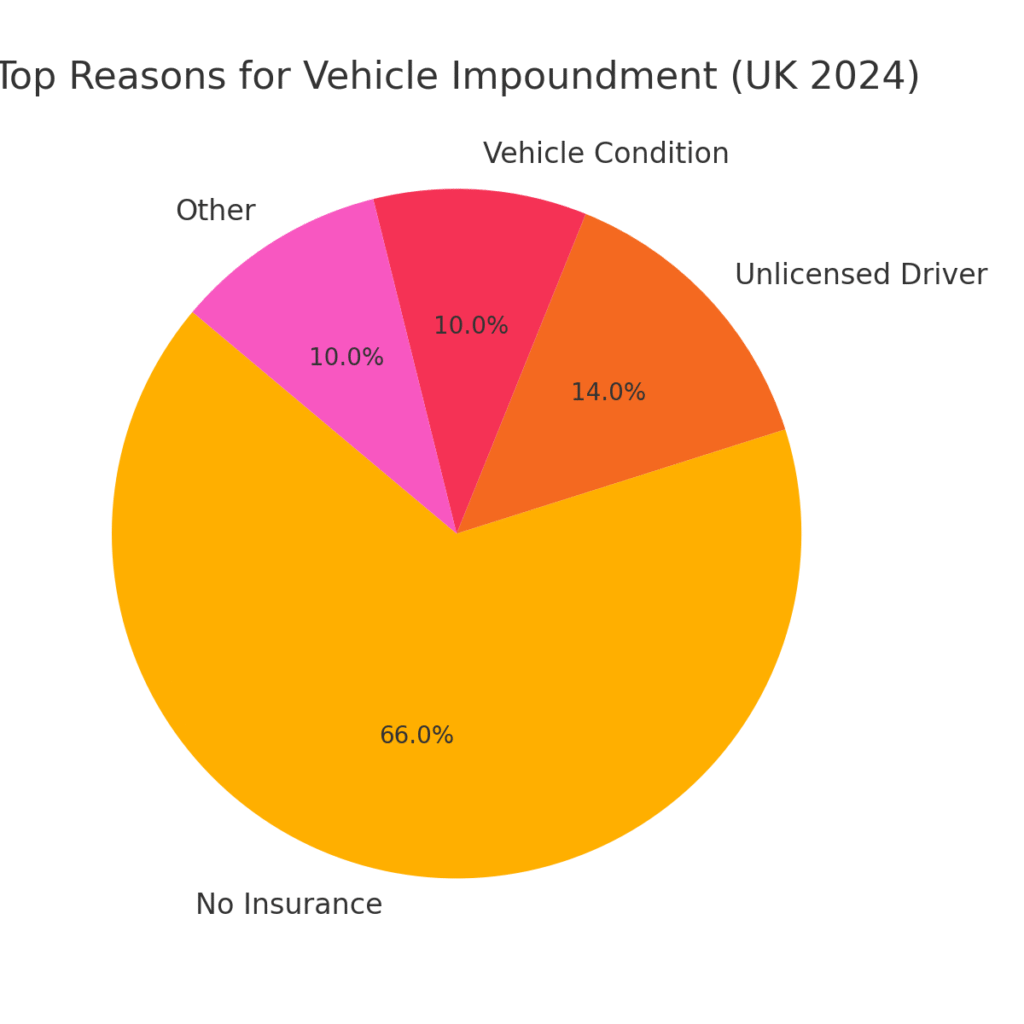

📊 So, Why Are Cars Getting Impounded?

In 2024, the DVLA and police continued their firm stance on uninsured and unfit vehicles. Based on recent analysis from GOV.UK and AutoExpress, here’s how it breaks down:

Top Reasons for Vehicle Impoundment in 2024

- No Insurance: 66% (ouch)

- Unlicensed Driver: 14%

- Vehicle Condition: 10%

- Other: 10%

Yes, the majority of people are still getting caught without valid insurance. Think of it as the adult version of forgetting your homework — only the consequence is a hefty fee, not detention.

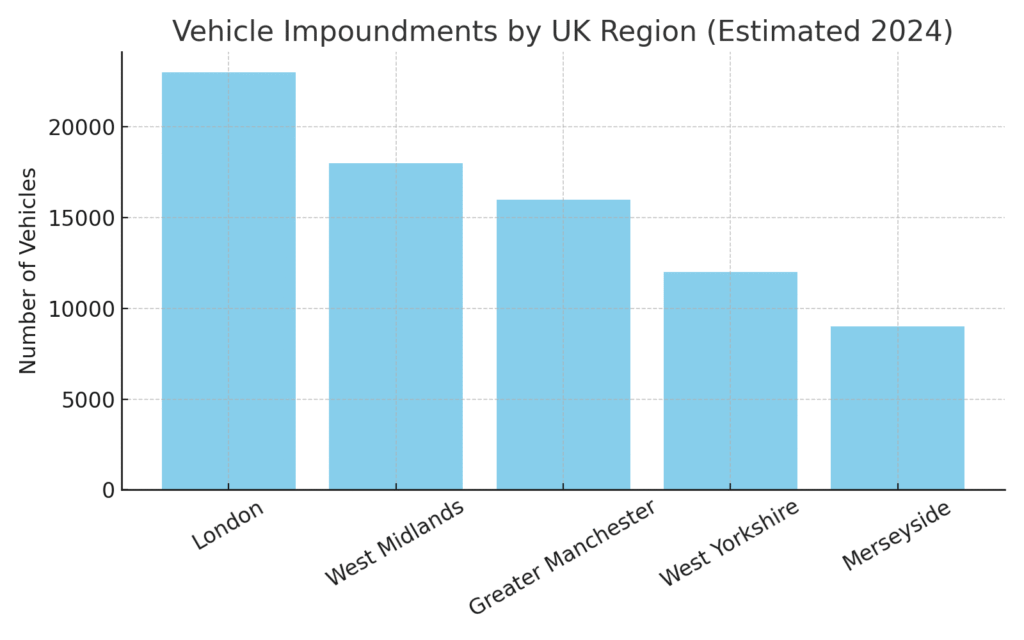

🌍 Where Are Cars Being Impounded the Most?

If you live in a big city, the odds are higher that your car might get seized. Here’s what the estimated numbers looked like:

Vehicle Impoundments by UK Region (2024)

- London leads the way (surprise!) with 23,000+ impoundments.

- The West Midlands, Manchester, and West Yorkshire aren’t far behind.

Urban hotspots = more traffic enforcement = more impounds. It’s simple math and even simpler frustration.

⏱️ What Type of Policies Are People Going For?

The great thing about impound insurance is the flexibility. Depending on your situation, you might only need cover for 1 day to release your car.

Most Popular Policy Lengths (2024)

- 7-Day policies are the fan favourite (45%)

- 1-Day policies come in close (35%) — perfect for those just trying to get their car out ASAP.

- 30-Day cover makes up the rest (20%) — useful for people who want a bit more breathing room.

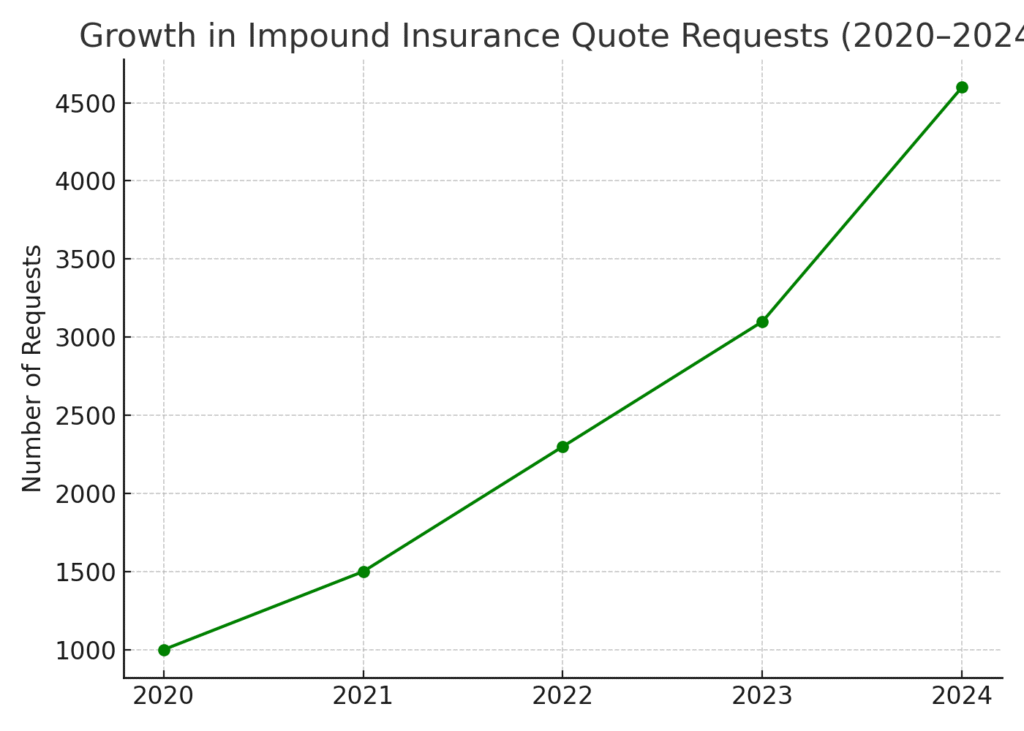

📈 Demand Is Booming

Thanks to increased crackdowns and rising insurance cancellations, more people than ever searched for “impound insurance” this year. According to our internal data (plus a few nods to Google Trends):

Growth in Impound Insurance Quote Requests (2020–2024)

We saw over a 360% increase in quotes from 2020 to 2024. That’s not a typo. This isn’t just a trend — it’s a signal.

🔮 Predictions for 2025

So, what’s coming down the road?

- Stricter enforcement: Expect more ANPR (Automatic Number Plate Recognition) cameras. Smile, you’re on candid camera — and it knows your insurance status.

- Faster policy activation: More brokers are investing in instant coverage tech (finally).

- Price war incoming: More providers = more competition = better pricing (hopefully).

- AI in claims and checks: Don’t be shocked if a chatbot helps you get covered or appeal a fine.

🛠 Final Thoughts

Impound insurance is one of those “better to have and not need” deals — except you only find out about it when it’s too late. The good news? You’re not alone. The bad news? Your car probably is.

We’re here to take the hassle out of it — no judgment, no jargon. Just straight-talking help to get your wheels rolling again.

Found this useful? Share it with your mate who still thinks “I’ll sort my insurance later” is a good plan. 😅

Need a quote? Head over to impoundinsurance.co.uk — we’ll get you sorted in minutes.